Bundesverband Alternative Investments e.V. (BAI)

Investor supervisory law in the fund industry refers to the supervisory regulation of the respective investors themselves.

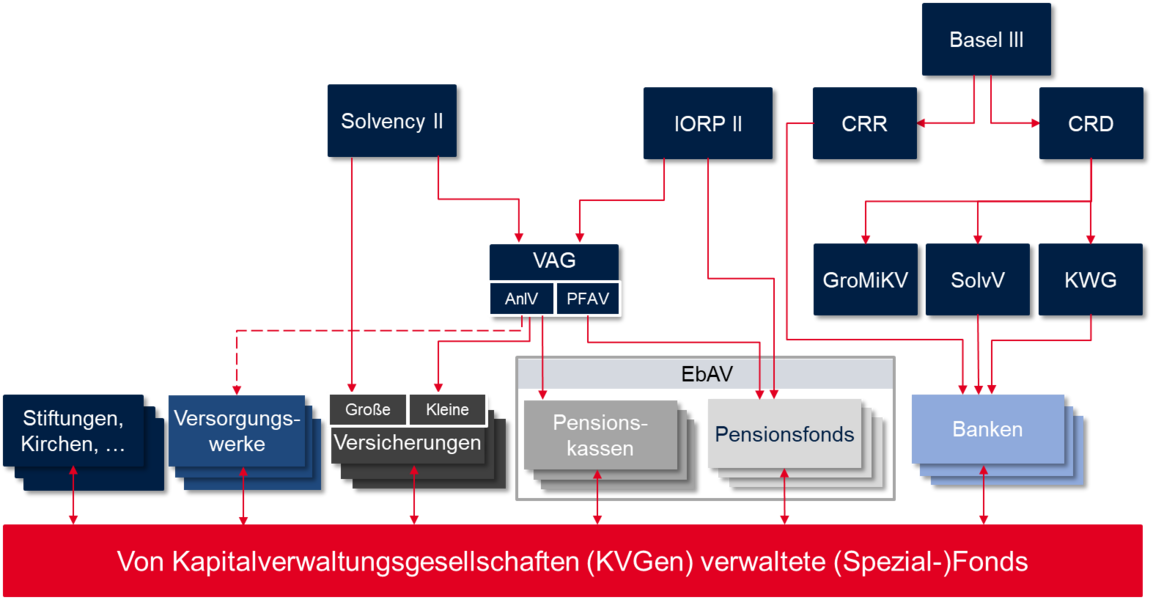

Institutional investors such as insurance companies, pension schemes, credit institutions, foundations or churches are the most important investors in open-ended special funds. They are usually subject to high regulatory requirements themselves in order to protect the respective policyholders, pension scheme beneficiaries or bank customers (or the financial market and financial market stability as a whole). Where the respective investor supervisory law (Solvency II for insurers, CRD/CRR for credit institutions and EbAV II for pension schemes, VAG and AnlV for small insurers or pension funds) sets regulatory requirements, fund companies (capital management companies - KVGs) are indirectly affected by their respective clients: A KVG should know the regulatory requirements of its investors in order to be able to offer suitable products/funds. For example, the KVG calculates the SCR requirement of an investment in accordance with Solvency II, is aware of the eligibility for the quotas or ‘numbers’ of the AnlV and fulfils the investor regulatory reporting obligations to which the investors are actually directly subject.

The following graphic overview illustrates the regulatory network into which investment management companies are indirectly involved via their customers/institutional investors, both at the level of EU law and German law.

Prudential Regulation of (large) insurers: Solvency II

(Large) insurance companies, along with pension funds, are among the most significant investors in special funds. About one-third of the assets of open special funds, or approximately 550 billion euros, come from the insurance sector.

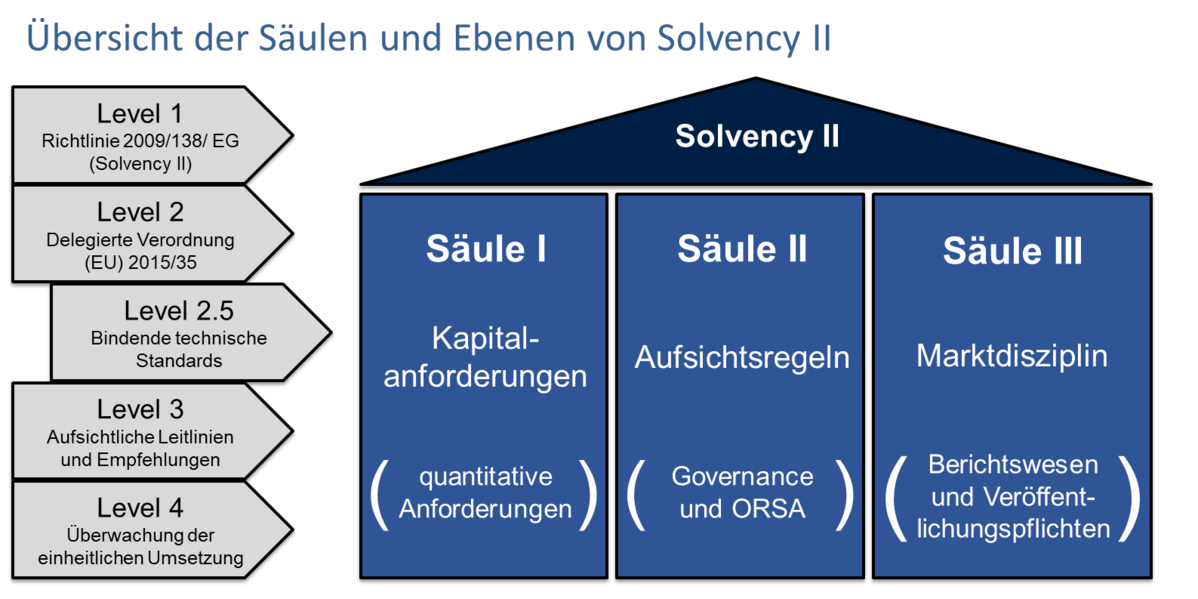

With the entry into force of the Solvency II Directive, this significant market was regulated across Europe in 2016. The directive focuses on risk-based solvency requirements for the capital adequacy of insurance companies, qualitative requirements for insurance companies' risk management, and expanded disclosure obligations.

The directive follows a three-pillar approach:

- Pillar I concerns the level of the Minimum Capital Requirement (MCR) and the level of the Solvency Capital Requirement (SCR) in relation to the Eligible Own Funds (EOF).

- Pillar II addresses the risk management system and includes mainly qualitative requirements, such as the qualifications of the management boards of insurance companies.

- Pillar III regulates the reporting obligations of insurance companies: on the one hand, reporting obligations to supervisory authorities, and on the other hand, disclosures to be published.

Additionally, there are regulations concerning the supervision of insurance groups.

According to the Solvency II Directive, insurers must comply with the Solvency Capital Requirement (SCR). This EU-wide standard formula considers the key risks of insurers' business activities.

The own funds are intended to protect insurance companies from insolvency and ensure that they can fulfill their insurance contracts and pay out customers even in adverse economic conditions. Depending on the type of assets in which insurers invest, these assets must be backed by varying levels of equity.

Therefore, insurers must know their individual invested assets; if these are bundled in investment funds, for example, in a special AIF with fixed investment conditions, a look-through approach must be applied. Accordingly, the so-called look-through approach includes the procedures provided by Solvency II for determining the market risk capital of investment funds.

EIOPA comments on sustainability risks

With the publication of a discussion paper on the macroprudential treatment of sustainability risks, EIOPA is advancing the sustainability discourse in investor supervisory law—the adjustment to these risks is seen by EIOPA as a central task for insurance markets. EIOPA is focusing on examining the connection between transition-related sustainability risks and macroprudential risks, adapting to climate risks in risk measurement, and strengthening the social components of ESG.

Discussion paper on the treatment of sustainability risks by EIOPA

Solvency-II-Review:

In September 2021, the EU Commission initiated a review process of the Solvency II Directive, which was concluded after intensive trilogue negotiations in the EU Parliament, EU Council, and EU Commission on January 25.

On April 23, 2024, the European Parliament approved the revisions to the Solvency II Directive. Additionally, the EU Parliament also passed the IRRD Directive, which provides a framework for the recovery and resolution of insurers in the EU.

The amendments aim to make the industry more resilient, better preparing it for future crises and providing better protection for policyholders. Small insurers will be exempted from certain regulations, the cost of capital for the risk margin will be reduced, and new rules for cross-border information exchange and liquidity risk management will be introduced. Insurers will also be required to assess climate risks, and investments in ELTIFs and AIFs with lower risk profiles will be facilitated.

Member states now have two years to implement the changes into national laws (in Germany, the VAG), so the amendments are expected to come into effect no earlier than 2026.

The Solvency II Implementing Regulation (Delegated Regulation /2015/35) on Level 2 of the Solvency II framework will also need to be adjusted during this period. The first consultations on this are expected later in 2024.

Draft proposal for Solvency II

Final compromise text on IRRD

Final compromise text on Solvency II

Regulatory update on Solvency II

Legal basis

Solvency II (Directive 2009/138/EC)

Solvency II Implementing Regulation (Delegated Regulation (EU) 2015/35), corrected by Delegated Regulation (EU) 2016/2283 and amended since then by Delegated Regulation (EU) 2016/467, which amended the calculation of regulatory capital requirements for various categories of investments, in particular for Qualifying Infrastructure, and by Delegated Regulation (EU) 2019/981, implementing the results of the SCR Review 2018 (first review of the standard formula).

Further information

The following very informative BaFin website contains bases in law, guidelines and BaFin’s interpretative decisions of on Solvency II of Level 2.5 (binding Technical Standards) and Level 3 (Supervisory Guidelines and Recommendations), including references to Q&A and guidelines of the European Insurance Supervision Authority EIOPA:

Bases in law, guidelines and interpretative decisions of BaFin on Solvency II

An interactive online graphic on Solvency II can be found on the GDV (German Insurance Association) homepage (in German only):

interactive online graphic on Solvency II

Further information can be found on the “Solvency II kompakt” homepage (in German only)

In order to meet the requirements as an “interface” between supervisors and insurers and to support insurance companies with the requirements for SCR calculation and reporting obligations, the investment industry of several countries has created the so-called "Tripartite Template (TPT) for Solvency II Asset Data Reporting". This EU fund data sheet supports and improves the exchange of data on the composition of fund portfolios between investment management companies and insurance companies.

Prudential Regulation of (small) insurers: German Insurance Supervision Act (VAG)/Investment Ordinance (AnlV)/BaFin Circular to the Investment Ordinance

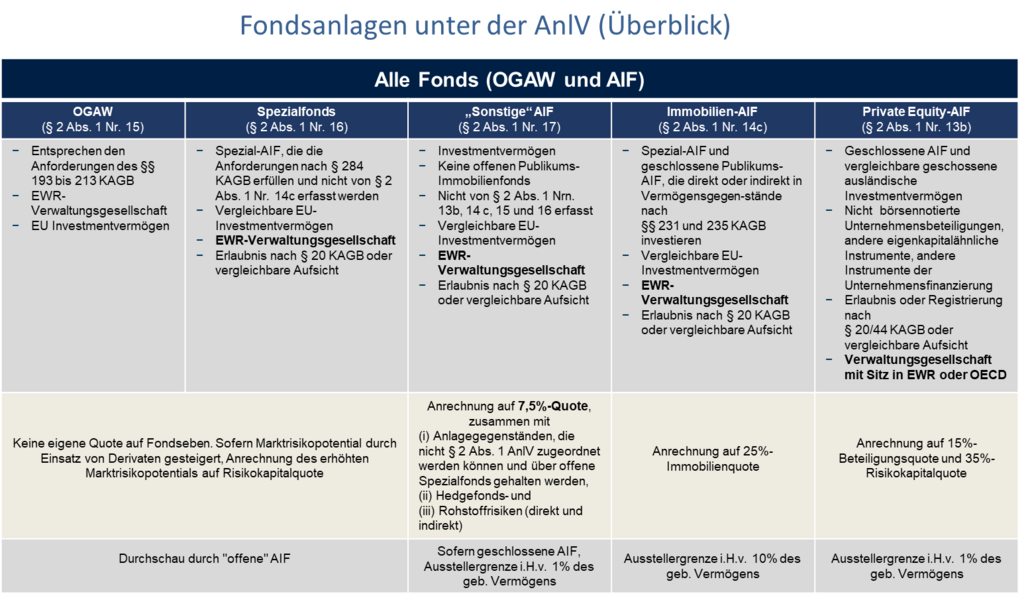

While "large" insurance companies are subject to Solvency II and its principle-based regulation, so-called "small" insurance companies continue to be regulated only by the VAG (Insurance Supervision Act). According to § 215, "the assets of the security assets under § 125 [...] are to be invested, taking into account the nature of the insurance business conducted and the company structure, in such a way as to achieve the greatest possible security and profitability while ensuring the insurance company's liquidity at all times, and while maintaining an appropriate mix and diversification." These investment principles for the security assets are further specified by the Investment Regulation (AnlV) and the Capital Investment Circular (AnlV-RS). In practice, in the structuring of funds for institutional investors, AnlV and AnlV-RS are of enormous importance because, before investments, questions regarding the eligibility/qualification for the respective items in § 2 paragraph 1 of the AnlV and the quotas of the AnlV must be clarified.

To adapt national legislation to the changes in the Solvency II Directive, an amendment to the VAG must be made by the beginning of 2026 at the latest. These adjustments also affect small insurers, as the changes to the Solvency II Directive aim to exempt them from some regulations.

The following graphic provides an overview of fund investments under the AnlV:

Legal basis

German Insurance Supervision Act (VAG) – convenience translation by BaFin

BaFin Circular 11/2017 to the Investment Ordinance (in German only)

Draft Bill for a Second Act to Strengthen Occupational Pensions and Amend Other Laws

The Federal Ministry of Labor and Social Affairs (BMAS) and the Federal Ministry of Finance (BMF) presented a draft bill for a second act to strengthen occupational pensions and amend other laws on June 27, 2024.

The draft bill proposes the following changes to the Investment Regulation:

- Introduction of a separate infrastructure quota of 5% of the security assets,

- Use of the opening clause for investments exceeding the applicable diversification limits, and

- Expansion of the venture capital investment quota from 35% to 40% of the security assets.

These changes are relevant for insurers, pension schemes, and pension funds insofar as they are subject to the Investment Regulation according to their internal investment guidelines. The draft aims to mobilize capital, particularly from institutional investors, for investments in infrastructure and renewable energy.

BAI Statement on the Second Draft Bill to Strengthen Occupational Pensions (only in German)

Prudential Regulation of „Versorgungswerke“ (pension schemes): Investment Ordinance (AnlV)/BaFin Circular 11/2017 – indirectly regulated by these acts qua law of the Länder

“Versorgungswerke” are some kind of pension funds, pension plans or pension schemes. Professional pension schemes ensure that the liberal professions of doctors, pharmacists, architects, notaries, lawyers, tax consultants and tax agents, veterinarians, auditors and certified accountants, dentists as well as engineers and psychotherapists are covered by compulsory old-age, disability and survivors' pensions.

As public-law compulsory pension schemes of "their own kind" – clearly distinguished from other pension schemes – they are based on a legal basis laid down by state law within the exclusive legislative competence of the "Bundesländer" under Article 70 of the Basic Law (“Grundgesetz”, the German Constitution).

The numerous pension schemes in the German Länder a high status as institutional investors. As public law corporations, they are supervised by the respective Länder (federal states) or state ministries. Although the pension schemes are not covered by the scope of application, the rules of the Investment Ordinance (AnlV) and BaFin’s Investment Circular 11/2017 to the Investment Ordinance are indirectly applicable in practice under state law/law of the Länder. One example is the provision in the articles of association of a pension scheme for self-employed members of a liberal profession, according to which the "assets of the pension scheme [...], insofar as they are not to be kept available to cover current expenditure, are to be invested in accordance with the principles of § 215 (1) of the Insurance Supervision Act (VAG) in the relevant version". Accordingly, the bodies of the pension schemes also indirectly apply the provisions of the Investment Ordinance (AnlV) and BaFin’s Investment Circular 11/2017 to the Investment Ordinance.

Legal basis

BaFin Circular 11/2017 to the Investment Ordinance (in German only)

Regulation of pension funds (“Pensionskassen”): IORP II/German Insurance Supervision Act (VAG)/Investment Ordinance (AnlV)/BaFin Circular to the Investment Ordinance

In many cases, occupational pension schemes are financed through direct insurance, pension funds or pension funds. The latter two are referred to for supervisory purposes as "institutions for occupational retirement provision" (in short: IOPRs). Direct insurance is offered by life insurance companies and is subject to Solvency II for supervisory purposes.

IORPs are subject throughout Europe to the EU Directive 2016/2341 (IORP II Directive, or Institutions for Occupational Retirement Provision Directive), which replaced the old directive from 2003. The IORP II Directive was transposed into German law by an amendment to the Insurance Supervision Act (VAG Part 4) on 13 January 2019 and has been in force since this date. According to § 1 (1) No. 1 of the Investment Ordinance (AnlV), the following applies to the implementation of the directive via pension funds: "This Regulation applies to the investment of guarantee assets of (a) Pensionskassen within the meaning of section 232 of the Insurance Supervision Act,, ...", why the more specific legal framework of the Investment Ordinance (AnlV) and BaFin’s Investment Circular 11/2017 for capital investments of pension funds apply.

Legal basis

IORP II Directive (Directive (EU) 2016/2341)

German Insurance Supervision Act (VAG) – convenience translation by BaFin

BaFin Circular 11/2017 to the Investment Ordinance (in German only)

Further information

Further information on the supervisory framework IORP II can also be found on the website of the “Arbeitsgemeinschaft betriebliche Altersversorgung e.V.” (aba):

Website of aba on IORP II issues

IORP II review

At the end of January 2023, the European Commission initiated the review process of the IORP II Directive with a call for advice. On March 3, 2022, EIOPA responded with a draft of its technical recommendations for the IORP II Directive, which was put forward for consultation. The final version of the technical recommendations for the IORP II Directive was published by EIOPA on September 28, 2023.

Proposals regarding the adjustments to the IORP II Directive include increasing the thresholds for inclusion in the exceptions for small IORPs, strengthening governance and risk management, and improving transparency and digitalization in information requirements. Additionally, sustainability factors should be considered in investment decisions, and diversity in management bodies should be promoted. These adjustments aim to align with modern developments and improve risk assessment, particularly in the context of the shift to defined contribution schemes.

Call for Advice by the European Commission on the IORP II Directive

Consultation on EIOPA's Technical Recommendations for the IORP II Directive

Final Version of EIOPA's Technical Recommendations for the IORP II Directive

Prudential Regulation of pension funds: IORP II/ German Insurance Supervision Act (VAG )/Regulation on the supervision of pension funds (PFAV)

In many cases, occupational pension schemes are financed through direct insurance, pension funds or pension funds. The latter two are referred to for supervisory purposes as "institutions for occupational retirement provision" (in short: IOPRs). Direct insurance is offered by life insurance companies and is subject to Solvency II for supervisory purposes. In Germany there are around 30 pension funds which are subject to BaFin’s supervision.

IORPs are subject throughout Europe to the EU Directive 2016/2341 (IORP II Directive, or Institutions for Occupational Retirement Provision Directive), which replaced the old directive from 2003. The IORP II Directive was transposed into German law by an amendment to the Insurance Supervision Act (VAG Part 4) on 13 January 2019 and has been in force since this date.

The regulatory framework for pension funds is also being further specified at ordinance level. However, the Regulation on the supervision of pension funds (PFAV) is applicable and not the Investment Ordinance (AnlV). The provisions of the PFAV on investment principles, investment management and forms of investment are similar to those of the AnlV, but the bottom line is that they are more liberal and less rigid overall. There are significant differences to the provisions for primary insurance companies and domestic pension funds, in particular with regard to the requirements for the mix of the various forms of investment (§ 18 PFAV). In this respect, pension funds have greater freedom of investments. BaFin’s Investment Circular 11/2017 contains a section "C. Separate notes on the investment of the guarantee assets of domestic pension funds".

Legal basis

IORP II Directive (Directive (EU) 2016/2341)

German Insurance Supervision Act (VAG) – convenience translation by BaFin

PFAV (in German only)

BaFin Circular 11/2017 to the Investment Ordinance (in German only)

Further information

Further information on the supervisory framework IORP II can also be found on the website of the “Arbeitsgemeinschaft betriebliche Altersversorgung e.V.” (aba):

Regulation of banks: CRD/CRR/German Banking Act (KWG)/GroMiKV/SolvV

Banks are also important institutional investors and, therefore, clients in (special) investment funds, accounting for approximately 11% of the assets of special funds. They are subject to numerous banking supervisory regulations. The Basel III framework, formalized in December 2010 by the Basel Committee on Banking Supervision with the document "A global regulatory framework for more resilient banks and banking systems," was implemented at the European level through the CRD IV/CRR legislative package. This package consists of a directive (CRD IV) and a regulation (CRR), which replaced the previous capital requirements directives. The CRD IV/CRR legislative package came into force on January 1, 2014. As part of the national implementation of CRD IV, the CRD IV Implementation Act significantly amended the German Banking Act (KWG) and the associated regulations (including SolvV and GroMiKV). The CRR is directly applicable.

Since 2016, drafts for the revision of the directive (then CRD V), regulation (then CRR II), and the Bank Recovery and Resolution Directive (BRRD) have been discussed. The so-called EU Banking Package, which includes CRD V, CRR II, BRRD II, and SRMR II, was published in the Official Journal of the European Union on June 7, 2019, and came into effect on June 27, 2019.

Banks or credit institutions have reporting obligations regarding capital requirements, capital deduction items, the countercyclical capital buffer, liquidity coverage requirements (LCR), risk-bearing capacity, large exposures, and the KVG million-loan reporting. KVGs are at the interface between funds and banks as investors in funds.

As with Solvency II and the calculation of SCR, KVGs also have (indirect or possibly contractual) obligations in bank reporting to determine risk weights under the CRR. This is done using the look-through method to determine the risk weight for investment units under the standard approach according to Article 132 paragraph 4 CRR in connection with the calculation of credit risk (Part 3 Title II Chapter 2 CRR) within the framework of reporting to institutions.

With the adoption of CRD VI and CRR III on May 31, 2024, the final Basel III requirements were incorporated into EU law. The implementation rules include changes to the standard and IRB approaches to clarify and standardize the calculation of risk-weighted assets (RWA). Additionally, a new framework for operational risks is being introduced, considering losses due to internal errors or external events. These measures are intended to improve the capital adequacy and stability of banks.

Furthermore, it was agreed to enhance banks' resilience to ESG risks, strengthen and harmonize bank supervision and risk management across the EU, especially regarding EU-licensed branches of third-country banks, and protect the independence of banking supervisory authorities.

CRR III will be binding for affected institutions from January 1, 2025, while CRD VI must be transposed into national law by member states by January 10, 2026.

Legal basis

CRD IV (Directive 2013/36/EU)

CRR (Regulation (EU) Nr. 575/2013)

CRD V (Directive 2019/878/EU amending Directive 2013/36/EU)

CRR II (Regulation (EU) 2019/876 amending Regulation (EU) Nr. 575/2013)

German Banking Act – convenience translation by BaFin

Solvency Ordinance to the German Banking Act (KWG) – in German only

Banking Package 2021

In October 2021, the adoption of a package to amend the Capital Requirements Regulation (then CRR III), the Capital Requirements Directive (then CRD V), and capital requirements in the area of resolution marked the beginning of the review of EU banking regulations. The drafts propose changes that build on the previous regulation of banking supervision following the 2008 banking crisis and aim to extend these regulations to address the challenges of post-pandemic economic recovery and ecological transformation.

The package consists of the following three core elements:

- Implementation of Basel III – Strengthening Resilience to Economic Shocks: The package implements the international Basel III agreement, considering the specifics of the EU banking sector, such as low-risk mortgages.

- Sustainability – Contribution to the Green Transition: The new regulations require banks to systematically identify, disclose, and manage sustainability risks (environmental, social, and governance risks or ESG risks) as part of their risk management.

- Stronger Enforcement Tools – Ensuring Solid Management of EU Banks and Better Protection of Financial Stability: The package provides stronger enforcement tools for the supervisory authorities overseeing EU banks.

The draft report of the Economic and Monetary Affairs Committee (ECON) of the European Parliament on CRR, accompanied by numerous amendments, was published on May 23, 2022. The BAI also published a position paper focusing on the assessment of the impact on equity positions and subordinated debt and capital instruments other than shares. With the entry into force of CRR III and CRD VI on July 29, 2024, the guidelines agreed upon in Basel III were fully implemented into EU law.

CRD VI (Directive (EU) 2024/1619 amending Directive 2013/36/EU)

CRR III (Regulation (EU) 2024/1623 amending Regulation (EU) No. 575/2013)