In 2018 the EU Commission published the “Action Plan on Sustainable Finance”. Since then, everyone has been talking about Sustainable Finance or ESG.

ESG is an English acronym, stands for "Environment, Social and Governance" and as an umbrella term means the consideration of sustainability goals in capital investments: in ecological terms, in social terms and with regard to (good) corporate governance. For example, "E" generally stands for the conservation of resources, environmentally friendly production, reduction of greenhouse gases, eco-efficiency with regard to energy, water, carbon dioxide and waste, energy management, investment in renewable energies etc., "S" for example for the observance of central labor rights, fair conditions at the workplace, occupational health and safety (also with suppliers), equal opportunities and diversity, prevention of exploitation and discrimination, freedom of assembly and trade unions etc., and "G" stands exemplarily for transparency in corporate governance and external communication, for the anchoring of sustainability management at the executive and supervisory board level and ESG risk management, the prevention of corruption, bribery and money laundering, for regulatory compliance and the avoidance of conflicts of interest.

The 2021 Finance Package contained measures to help make Europe climate-neutral by 2050. In December 2021, a first legislative act on sustainable activities for climate change mitigation and adaptation targets of the EU taxonomy was published. The Commission adopted a proposal for the CSRD, which included more detailed reporting obligations for sustainability reporting. On June 13, 2023, a new package of measures was presented, which primarily aims to increase transparency for sustainable investments on the market. The Commission package contains the delegated act for environmental protection for environmental objectives 3-6 and the delegated amending act for climate protection. It also includes a legislative proposal for an EU regulation on ESG ratings. The delegated acts on the taxonomy are intended to facilitate investments in other sectors and economic activities that contribute to achieving the EU's climate targets. The Taxonomy Navigator in particular contributes to a more user-friendly application.

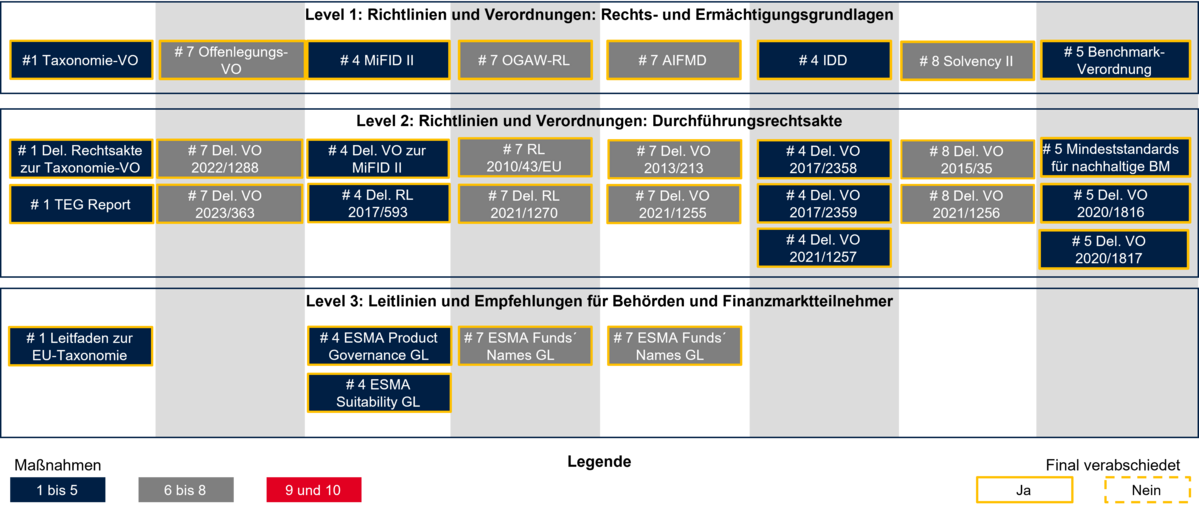

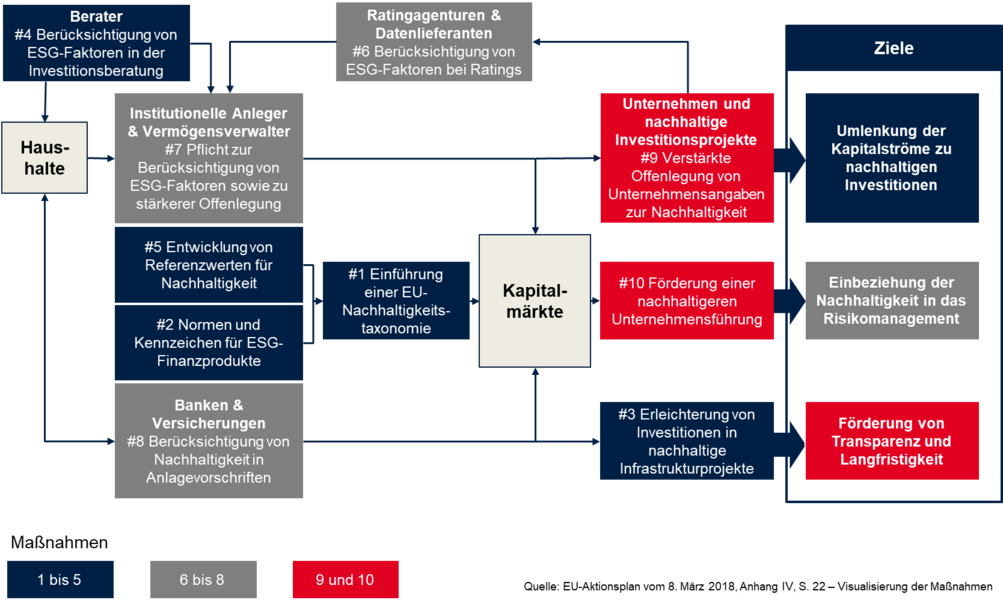

With the "Action Plan on Sustainable Finance" the EU Commission has launched an extremely voluminous legislative initiative. The Action Plan comprises ten (legislative) measures which are intended to contribute to the achievement of three objectives, as visualized in the graphic below:

- The re-orientation of private capital flows towards sustainable investments (measures 1-5; dark blue)

- The fostering of transparency and long-termism in markets (measures 6-8; dark grey)

- The embedding of sustainability risk into risk management (measures 9-10, red).

The Action Plan includes a wide range of initiatives such as

- The taxonomy regulation to create a uniform classification system for sustainable activities

- The Sustainable Finance Reporting Regulation (SFDR), the so-called Disclosure Regulation, to create consistent disclosure requirements with regard to sustainability

- A CO2 benchmark regulation to provide standardized sustainability benchmarks

- New secondary legislation or "delegated acts" to integrate sustainability risks and factors into the UCITS Directives and the AIFMD framework, i.e. for the entire fund industry

- New delegated acts to integrate sustainability risks and factors into the MiFID II and IDD frameworks (including the integration of sustainability considerations into financial advice)

- The development of a standard for Green Bonds

- The development of an EU eco-label for financial products (EU Ecolabel)

- Updating the non-financial reporting of companies as part of a review of the Non-Financial Reporting Directive (NFRD).

Of the entire legislative package of the Sustainable Finance Initiative, measures #1 (Taxonomy Regulation), #2 (standards and labels for environmentally friendly financial products/green financial products), #4 (incorporating sustainability as part of financial advice), #6 (developing sustainability benchmarks and better integrating sustainability into ratings), #7 strengthening the disclosure made by asset managers and financial advisors to their clients, including the Disclosure Regulation) and #9 (strengthening the rules on disclosure of sustainability information and accounting) are the most relevant and important legislative acts for funds and their management companies.

In our Investor Survey 2022, we dedicated a separate chapter to the topic of sustainable finance and ESG. We have compiled and analyzed the results in a short video.